How Federal Government Workers Can Make The Most Of Their Thrift Savings Plan Options

How Federal Government Workers Can Make The Most Of Their Thrift Savings Plan Options

By Matt Bell | 12/21/16

The Thrift Savings Plan (TSP), the U.S. government’s 401(k)-type retirement plan for federal workers, has undergone an important change since SMI last wrote about it. We’ll get to that change in a moment, but first a little background.

Generous benefits

The TSP is one of the world’s largest defined-contribution retirement plans, with approximately 4.8 million participants and more than $458 billion in assets. Participation is open to active employees of the Federal Employees’ Retirement System (FERS), the Civilian Service Retirement System (CSRS), the uniformed services, and certain other categories of civilian government service.

The program offers a number of valuable benefits, especially for FERS employees. First, Uncle Sam makes an automatic contribution equal to 1% of the employee’s salary each pay period. There is no waiting period and the employee doesn’t have to be making any contributions of his or her own. (There is a two- to three-year vesting period, depending on the type of position the employee holds.)

Next, the government matches any contributions an employee makes dollar for dollar up to 3% of salary. Then, for the next 2% of salary, the government contributes 50 cents per dollar.

If you’re covered under the Federal Employees’ Retirement System, a great goal is to invest at least 5% of your salary. That will enable you to take full advantage of the free matching money.

For all TSP-eligible employees, the maximum annual amount that may be contributed to the plan in 2017 (not counting employer matches) is $18,000, with an additional $6,000 allowed for participants age 50 and older.

Traditional and Roth options

Originally, all TSP accounts were similar to traditional 401(k)s. Employee contributions were tax-deductible, with taxes due on the contributions and earnings when money is withdrawn in retirement. In 2012, a Roth TSP option was added. Just as with a Roth IRA or 401(k), money is contributed to a Roth TSP after the employee has paid income tax on it. When the contributions and earnings are taken out in retirement, no tax is due.

TSP-eligible employees may choose the traditional TSP, the Roth TSP, or a combination—in which case they would spread their contributions across the two plans while adhering to the previously described contribution limits.

Automatic opt-in

One TSP feature unique to FERS employees hired after July 31, 2010 is an automatic 3% employee contribution. In other words, instead of having to take the initiative to opt in to the program, they have to opt out if they do not want to participate. This opt-out provision is a relatively new trend among retirement plans, and has proven to help people save more for their retirement than traditional opt-in programs. (While 3% is a good start, that amount is unlikely to be enough to meet your retirement savings goals, so make sure you’re investing enough either by contributing more to the TSP or to an IRA.)

Automatic investment selection

Investment options in the Thrift Savings Plan include three stock funds (the I, S, and C funds—International, Small Cap, and Common Stock), two fixed-income funds (the F and G funds—Fixed Income and Government Securities), and five blended “lifecycle” funds (L funds), which operate like target-date funds. An employee would choose the fund with the target date closest to his or her intended retirement date. The TSP’s lifecycle funds are offered in 10-year increments: L Income (for those currently in retirement), L 2020, L 2030, L 2040, and L 2050.

Each L fund is composed of a mix of holdings in the five stock and bond funds (I, S, C, F, and G). The more distant the target date of each lifecycle fund, the more it will allocate to the three stock funds. The closer the target date, the greater the allocation to the two fixed-income funds.

All TSP funds have low expense ratios, and all can now be tracked using SMI’s Personal Portfolio Tracker tool. (Previously, only the I, S, C, and F funds were in the Tracker.)

Don’t set it and forget it

By default, contributions to the TSP made by or on behalf of civilian employees who enrolled in the TSP prior to September 5, 2015 (and members of the uniformed services) are deposited into the G fund. Over the years, that design feature of the TSP has been criticized. After all, the G fund is a very conservative choice, especially for younger employees, and many never take the initiative to change that default selection.

As a result, the default investment choice for new TSP employees enrolled on or after September 5, 2015 is the L (lifecycle) fund with the target date closest to the date that the employee will turn 62.

All TSP participants would be wise to double-check how their contributions are being invested. If yours are still going into the G fund by default, you may want to make a change.

Even if your contributions are going into the L fund chosen for you by the TSP system, it’s important to note that choice may be more conservative than is ideal.

The TSP lifecycle funds tend to lean to the conservative side when compared to other target-date funds. For example, the most aggressive fund, L 2050, maintains a 16% allocation to bonds. By contrast, Fidelity’s 2050 target-date fund has only a 5% bond allocation.

Plus, remember that the system’s default assumes you plan to retire at age 62. If you plan to retire later than that, you should at least consider choosing an L fund with a later target date, assuming one is available.

If you’re investing in an L fund, take a look at its asset allocation and compare that to the optimal asset allocation suggested by SMI’s asset-allocation process. You can work through SMI’s process by visiting the Start Here section of the SMI web site (available only to SMI members). You may be able to get closer to your optimal asset allocation using the TSP’s stock funds (I, S, and C) rather than an L fund.

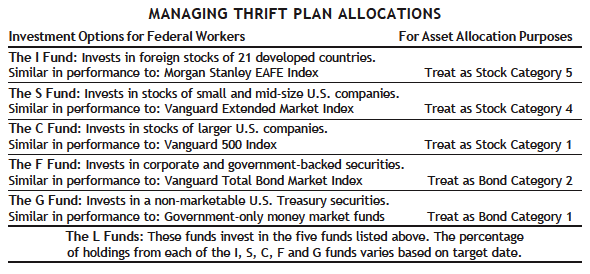

The table below shows where each TSP fund fits in terms of SMI’s risk categories. (Note that the TSP stock funds don’t separate the growth and value components, so the C Fund is really a combination of SMI Stock Categories 1 and 2, while the S Fund is a combination of SMI Stock Categories 3 and 4.)

If the TSP is your only retirement account and you want to build, for example, an 80% stock, 20% bond portfolio, you might use SMI’s Just-the-Basics allocations as your guide. That would mean putting 16% in the I fund, 32% in the S fund, 32% in the C fund, and 20% in the F fund.

If you have other investment accounts (such as an IRA) in addition to your TSP account, treating all of your accounts as one portfolio may enable you to implement SMI’s Fund Upgrading strategy, using your IRA or other account to specifically target investments in SMI stock categories 2 and 3 and the Upgrading “rotating” bond selection. These would complement your TSP holdings, which favor SMI stock categories 1, 4, and 5 as well as bond categories 1 and 2.

To learn more about the TSP, visit www.tsp.gov where you’ll find a downloadable 36-page booklet, Summary of the Thrift Savings Plan (PDF). You also may want to download the more detailed 192-page Your Thrift Savings Plan, a free privately produced guidebook.

Read the full article here1