At Federal Employee Service Association (FESA), we know that Social Security can be overwhelming and confusing, but we're here to help you. There are a lot of options such as individual planning, spousal planning, divorce planning, widow(er) planning, etc.

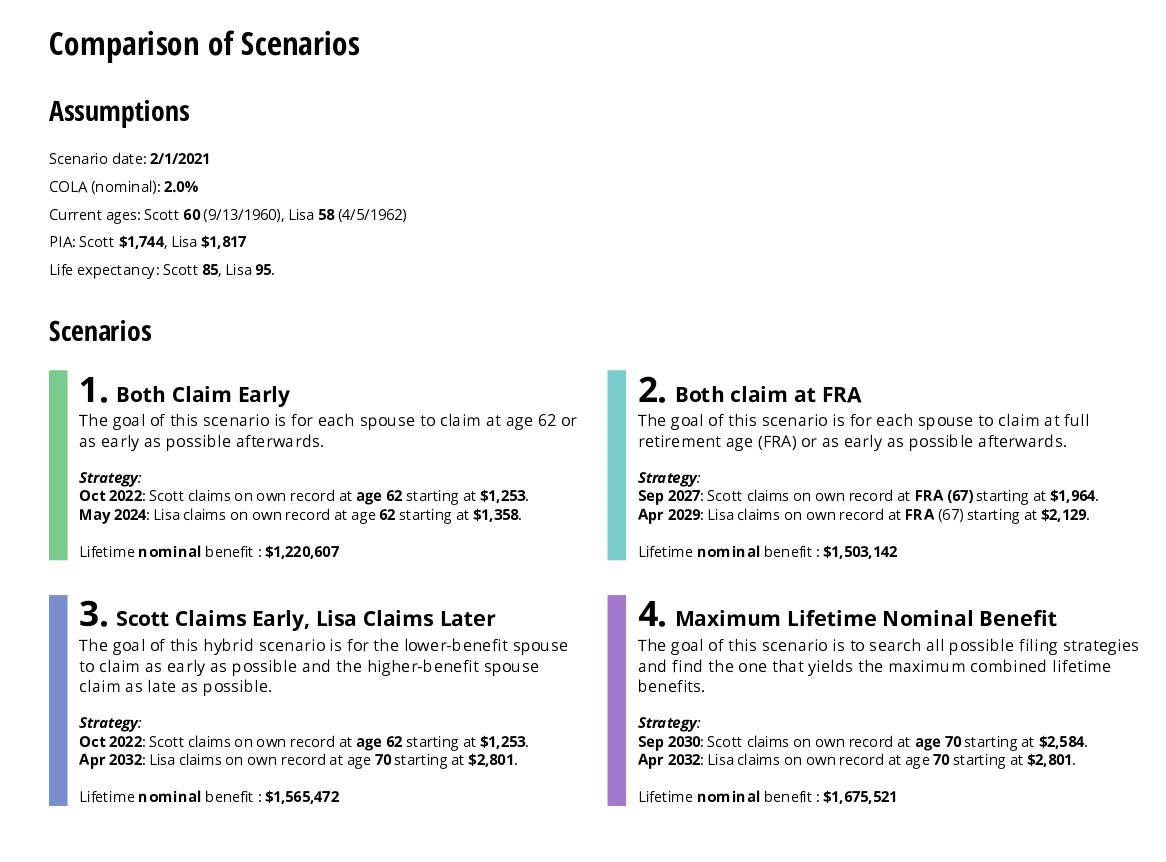

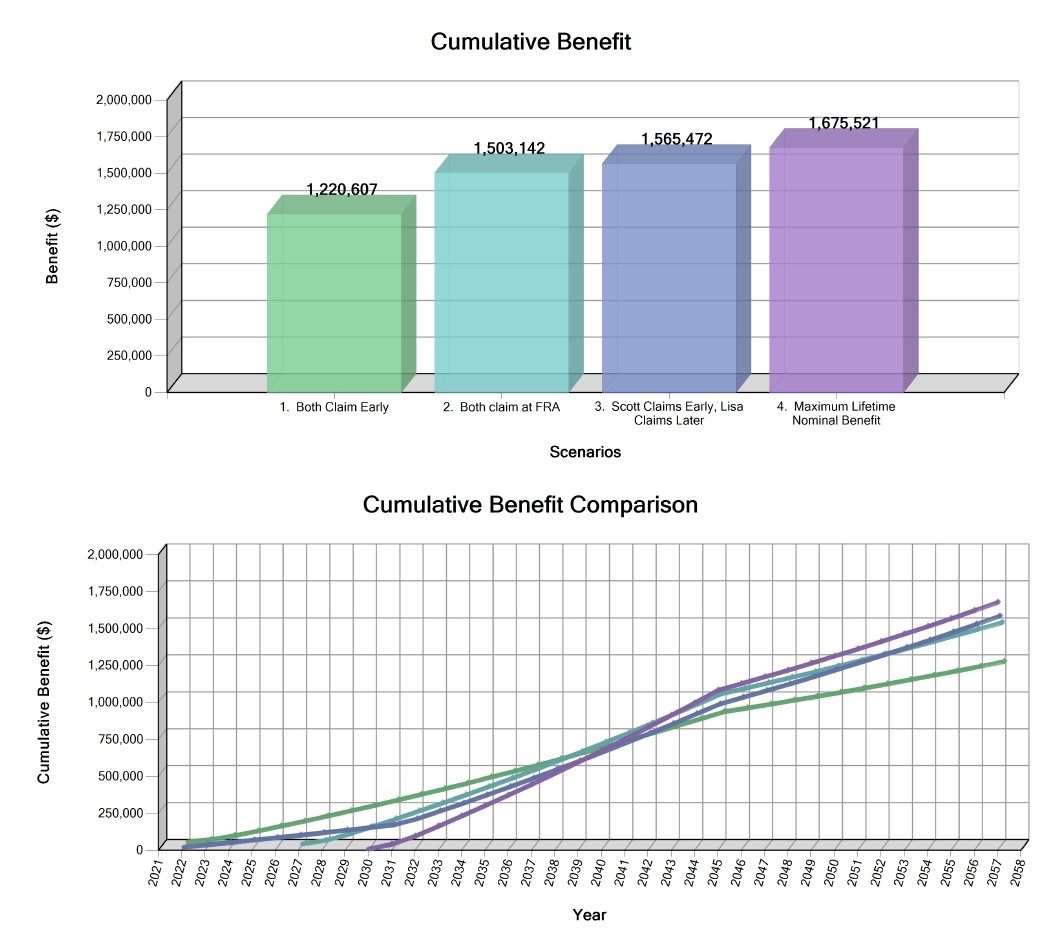

On top of that, when you claim and how you claim can make a difference of hundreds to thousands of dollars, so it's important to know how to maximize your benefits. We offer a free Social Security Report to help you do just that!

The Social Security Administration (SSA) is only able to provide information, not advice. That is actually written in their handbook! Crazy, right

That's where we come in! Our report will show you the best 3-5 options for your specific situation so that you are getting the most money possible and can coordinate your Social Security benefits with your other retirement savings.

We showed a Social Security report to Ron K., a retired Postmaster, and he said,

"I wish I had known this information - my wife and I wouldn't have claimed when we did. We claimed just because we could."